Long term public debt issues

The main driver behind the group's debt requirement is the capital investment programmes of United Utilities Water Limited. The group has fully pre-funded its investment requirements for its AMP7 regulatory period (2020-25) and has begun funding its AMP8 (2025-30) investment programme. As at 30 September 2024, the group had liquidity out to 2026.

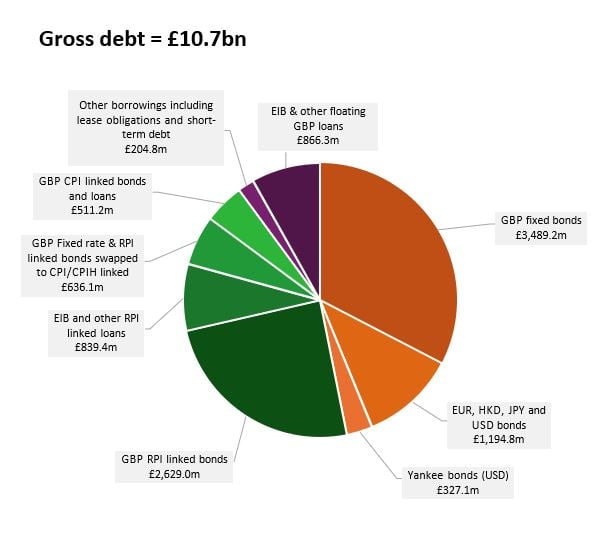

Below is a chart detailing our gross debt position as at 30 September 2024.

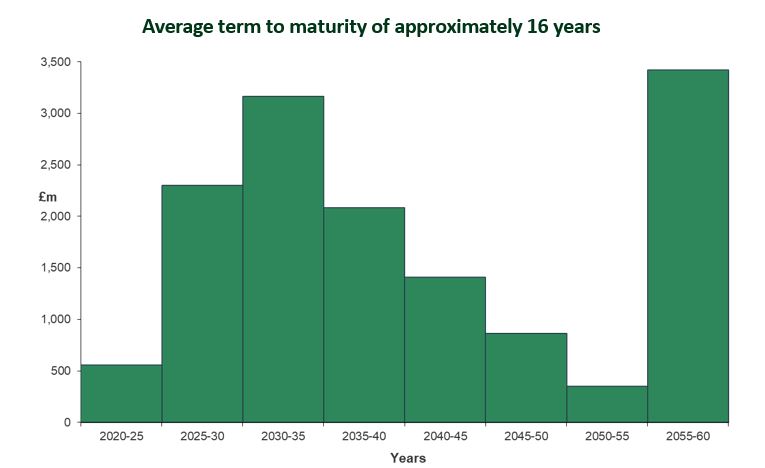

Below is a chart detailing our term debt maturity profile as at 30 September 2024.

Yankees

More information on long term public debt issues - Yankees

Euro medium term notes

More information on long term public debt issues - Euro medium term notes